Introduction

This primer will guide you through the intricacies of raising debt as an early-stage cashflow-negative SaaS company backed by VC investors. It’s complex, but you’re expected to get the basics as a founder1. That’s life for you. In short, two types of loans are available.

Working capital loans

As a SaaS company with a monthly recurring revenue (MRR) of over 10,000, you can trade recurring customer contracts as security for upfront cash payments to be repaid over 6 to 12 months. You can only secure a certain percentage of your MRR as you need to pledge another percentage of your MRR as security in case of customers not paying or churning. Your working capital capacity will increase as you grow and show that you’re a reliable payer. This type of working capital loan is, in effect, the same as offering your customers to pay cash upfront for a one to three-year contract at a discount to the monthly cash price.

Term loans

As a SaaS company with an annual recurring revenue (ARR) of 3 million or more with a solid equity-based buffer, you can offer a senior security lien on all your business assets for a cash loan to be repaid within 24 to 60 months. The typical loan terms offered to early-stage SaaS companies include high-interest rates, monthly revenue share, priced warrants, and success bonuses on exits during the loan term. At the cheaper end, bank debt is often secured by government institutions and administered by local banks. On the more expensive side, there are loans provided by international private debt funds such as venture debt and revenue-based financing providers.

Illustrative loan terms

While we’re not debt providers, as a fractional CFO working for SaaS companies, we’ve seen enough term sheets to establish rules of thumb on what terms to expect (as of Q4’23). These terms vary by lender and can be negotiated, especially if more than one lender is interested in working with your company.

- For a term loan, up to 12 months existing cash runway or a recent VC equity round

- Effective interest rate premiums of 600 to 800 basis points above EURIBOR. This premium can be up to 50% lower in the case of banks lending from their balance sheet

- Loan-related fees of around 1-3%, not including due diligence and legal fees for the loan documentation (which will be an additional expense to the company)

- In the case of warrants, expect a priced warrant coverage of 10-15%

- In the case of revenue-based financing, expect a revenue share, in lieu of an interest rate, of +/- 0.5x of the loan amount

- In the case of a term loan, a board (observer) seat, or monthly information rights

- Loan term of up to 60 months with an interest-only or revenue share-only period of up to 12 months

- An initial term loan tranche of up to 50% of ARR, possibly with a second tranche available subject to a minimum ARR growth

- Once a term loan is agreed, it has to be drawn fully or in minimum installments within a period of up to 12 months

- A working capital facility of over 50% of MRR and growing in line with MRR

- Senior secured loan with limited financial covenants and no personal guarantees

Getting debt term sheets is simple if you meet the lender criteria. Moreover, deciding what kind of loan is suitable for your strategic growth plan and negotiating the debt repayment profile and term sheet clauses can be done, if needed, professionally and cost-effectively with an experienced corporate finance advisor who sets up and supports you through an RFP-type auction process.

Diverging interests of debt providers and your investors

However, in contrast to large operating cashflow-positive companies, there are some unique pros and cons of raising debt applicable to an early-stage cashflow-negative SaaS company backed by VC investors.

Pros

- Debt is a less dilutive form of capital to the founder and other equity shareholders

- Debt can be used to bridge to a new equity round at a higher ARR and valuation

- Debt can be used to reach an ARR threshold that makes your company an attractive M&A target for strategic buyers

Cons

- Debt has to be repaid, which, in the case of underperformance to your growth plan and lack of a new equity round, can lead to a payment default and company bankruptcy

- Debt has first claims to any cash proceeds ahead of the preference shareholders, eliminating their preference returns in low exit scenarios

- As an early-stage company with no or limited ability for cashflow generation, the interest premium and other economic terms will be relatively expensive

Given these pros and cons, your VC investors may be an obstacle to raising debt. This is the case because a debt provider for the outstanding term of the loan (1) will have first rights on cash distribution in an M&A exit or liquidation event, and (2) will add restrictive covenants on profit dividends and additional (shareholder) debt. By contrast, you have sold shares with preference rights to your VC investors. This typically means they have (1) preference rights to get at least their initial investment returned in an M&A exit or liquidation event and (2) a veto right on the distribution of profits, raising debt, and selling equity. To make matters worse, early-stage debt providers, to safeguard their interests, may require a board seat or a board observer position.

For a cashflow-negative company with a decent-sized probability of generating a low equity return, this situation pits high-risk equity and high-yield debt investors against each other. Your key to unlocking this conflict of interest is to get the process underway. Non-binding debt term sheets will sharpen the motivation of all parties at the table to find a compromise.

Potential value creation of debt

With no exception, maintaining and reaching a cost-efficient SaaS growth takes a lot of cash fuel. High growth is a prerequisite to raising a new VC round. So, as a diligent founder, you’ve got no option but to (always) work on your follow-on capital raising plan. One possibility to get cash in the bank is to raise debt.

Let’s assume you’re the founder of a SaaS company that has crossed 5,000,000 in ARR and raised a much-needed insider bridge round of 2,500,000. Overall, you’ve reduced your projected cash burn multiple to 1.0x and project a 50% year-on-year growth to an ARR of 7,500,0002.

Is it a good idea for you to take out a loan? Let’s consider an example and assume you can raise equity at a pre-money valuation of 5.5x ARR with a dilution of 17.50% in a new equity round 12 months from raising the debt. For simplicity, we assume that the valuation multiple and dilution are the same as when you closed the bridge round with your existing investors. You’ve matched your growth plan and have reached an ARR of 7,500,000. Let’s also assume you raised debt with a 12-month interest-only period, you have the original loan of 2,000,000 less interest payments and expenses of 300,000 sitting as cash in the bank. As you’re likely to present a negative cash flow growth plan to new VC investors, they may argue that the available cash is for working capital and that your net debt equals 100% of your outstanding loan. Their pre-money valuation will be adjusted for net debt.

You may get VC investor feedback that, “The debt is too expensive.” and “A new equity investor will be against their equity being used to repay debt.” The debt provider will argue for a risk premium and an upside if their money is used to create an excellent future exit. And guess what? A new equity investor will deduct the outstanding loan against their pre-money offer and consider the cash in the bank as a necessary runway buffer before taking the opportunity to their investment committee.

What do the numbers tell us? At the new pre-money valuation of 39,250,000 (adjusted for net debt of 2,000,000) and dilution of 17.50%, you raise 8,325,758 in new cash, which, combined with the cash remaining from the loan of 1,700,000, provides you with a total cash balance of 10,025,758.

Do you think this is a good outcome? Seems like it. Without the buffer of a loan, which, according to your plan, you’ve not had to use, you would have had to reduce growth to conserve your cash runway. You would have entered a downward spiral where potential new investors doubted your forward-looking growth assumptions based on the latest month’s performance and the low cash balance. On the other hand, if you miss your targets and cannot raise additional cash, you could be in big financial trouble.

Debt simulations

This section compares the costs of different types of loans given some usual terms. You can go to the simulation (here), adjust all the inputs, and see the changes directly in the comparison table and graph.

Venture debt

A senior secured term loan with warrants, with the following terms:

- Facility amount is 2,000,000 or 40.00% of ARR

- Loan term is 48 months, with an interest-only period of 12 months

- Arrangement fee is 1.50% and end-of-term fee is 0.50%

- Base interest rate is 4.50% with an interest premium of 6.50% for a total annual interest of 11.00%

- Warrant coverage of 10.00% gives the right to purchase (ordinary or preference) shares for an amount of 200,000 at a strike price tied to a discount of 30.00% to the new equity round, valid for 7 years. This amounts to an equity dilution of 0.73%

Revenue-based financing

A senior secured term loan with a monthly revenue share, with the following terms:

- Facility amount is 2,000,000 or 40.00% of ARR

- Loan term is 48 months, with a revenue-share-only period of 12 months

- Arrangement fee is 1.00% and end of term fee is 0.00%

- Monthly revenue share is 3.00% up to a maximum of 0.55x of the facility amount. The annual revenue share amounts are capped to spread them out over the loan term

Bank debt

A senior secured term loan with a success bonus, with the following terms:

- Facility amount is 2,000,000 or 40.00% of ARR

- Loan term is 48 months, with an interest-only period of 12 months

- Arrangement fee is 1.50% and end of term fee is 0.50%

- Base interest rate is 4.50% with an interest premium of 4.50% for a total annual interest of 9.00%

- A 3.00% success bonus in case of an exit during the term of the loan

Working capital facility

A short-term loan secured against customer contracts, with the following terms:

- Current ARR is 5,000,000, and the eligible MRR for security is 45.00%

- For a 12-month repayment period, the upfront cash payment discount is 90.00%

- The eligible MRR to be secured is 187,500, and the facility amount is 168,750

- The cost of setting up the working capital facility is 1.00%

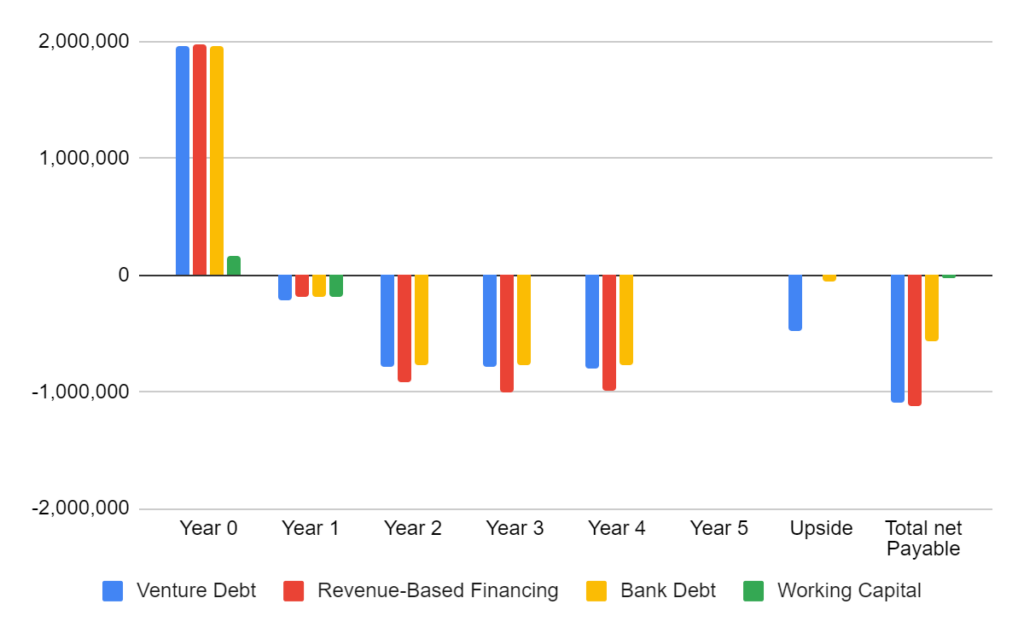

Debt comparison

As can be seen in the table, venture debt and revenue-based financing are relatively expensive forms of high-yield debt, where the total net payable has to take into account potential upsides of warrants, etc. Bank debt is less expensive, but this type of lender tends to be more conservative in who they’ll lend money to and require more stringent financial covenants. Working capital provides a small amount that can be helpful for short-term cash planning but conflicts with term loans on their indebtedness and security requirements.

| Venture Debt | Revenue-Based Financing | Bank Debt | Working Capital | |

|---|---|---|---|---|

| Facility Amount | 2,000,000 | 2,000,000 | 2,000,000 | 168,750 |

| Term (mths) | 48 | 48 | 48 | 12 |

| Interest / Revenue Share only period (mths) | 12 | 12 | 12 | 0 |

| Total Fees | 40,000 | 20,000 | 40,000 | 1,688 |

| Interest Payments / Revenue Share / Discount | 577,188 | 1,100,000 | 469,581 | 18,750 |

| Effective Interest Rate | 11.00% | 13.75% | 9.00% | 11.11% |

| Net Warrant / Exit Bonus | 472,182 | 0 | 60,000 | 0 |

| Total net Payable | 1,089,370 | 1,120,000 | 569,581 | 20,438 |

| as % of Facility Amount | 54.47% | 56.00% | 28.48% | 12.11% |

As input to your cash planning, the graph shows the net cash amount received upfront, annual payments, the warrants and exit bonus upside, and the total net payable per facility.

To calculate the net value of the warrant and the exit bonus, we’ve assumed an exit event in the last month of the loan term. Annual pre-money appreciation for the net warrant valuation is assumed to be 33%.