🤔 How a VC values your early-stage SaaS start-up

A typical starting point for a valuation discussion with a VC is its desire to own a particular percentage stake in your SaaS start-up for its investment amount.

👁️🗨️ The VC may tell you: “We are ready to invest €5M for a 20% stake with an employee equity option pool of 10% post our investment. This is 5.0x your SaaS ARR of €5M, which is a fair market valuation and as high as we are ready to go.”

The math behind this statement in percentage terms is if you own 100% before the transaction afterward, you will own 70%, as 10% of your existing shares are put into an equity option pool(1), and the VC bought 20% via newly issued preference shares. In valuation terms, a €5M investment purchased a 20% stake for a headline post-money valuation of €25M. As your SaaS ARR is €5M, the VC’s valuation multiple to ARR is 5.0x.

The VC will tell you its valuation multiple is in line with your peer group without too much further detail. Of course, behind the scenes, a VC partner rigorously assesses if the probability-weighted return is enough to pass its investment committee.

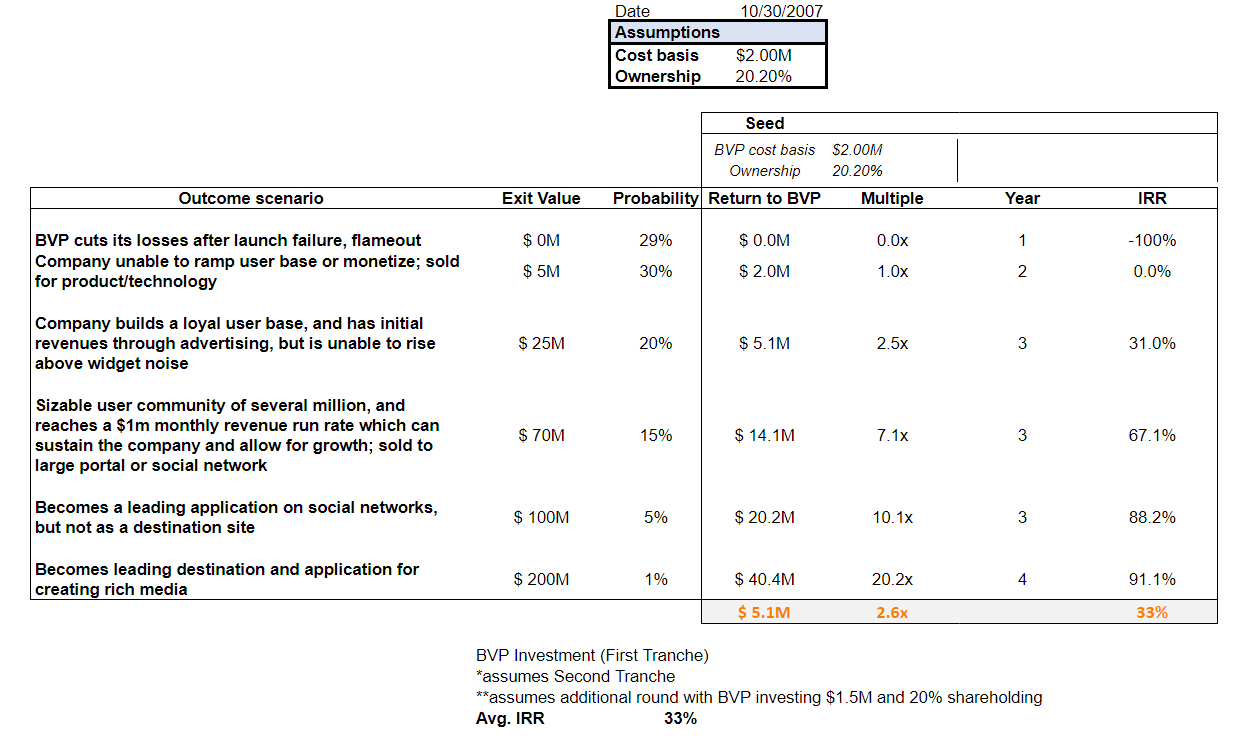

You can get a feel for how VCs do this by reading Bessemer Venture Partners’ redacted investment memos, like this one for their investment in Wix or this one for their investment in LinkedIn. BVP’s weighted probability of different outcomes valuation for Wix looks like this:

The probability-weighted valuation approach is one of a few suitable ones for an early revenue traction and non-profitable SaaS start-up. There needs to be more track record of producing reliable cash flow forecasts for a traditional discounted cash flow valuation. Regardless of what you’re told to believe, peer group valuations are more or less irrelevant because early-stage start-ups do not list on a stock exchange or change hands in a strategic majority sale for many years after the early-stage VC investment. In simple terms, revenue stream maturity and predictability determine which valuation method suits a VC-backed start-up.

| Start-up stage | Typical VC round | Suitable valuation method |

|---|---|---|

| Pre-revenue (<€500K) | Angle, Pre-Seed, Seed | Berkus, Score card |

| Early revenue traction (<€5M) | Series A, Series B | Probability-weighted |

| Strong revenue traction (>€10M) | Series C, Later Stage | Peer group, DCF |

An early-stage VC is concerned about downstream valuations and liquidity as it relies on later-stage VCs to share the burden of funding many years of losses before a SaaS start-up can achieve a successful exit. In this sense, the VC industry is an assembly line. When one station breaks down, other stations grind to a hold.

👉🏼 Simulation of a VC’s weighted probability SaaS start-up valuation

For your convenience, I’ve created a dynamic simulation of a weighted probability of different outcomes valuation where you can change the parameters to fit your situation). You can scroll to review my default example and set the input assumptions for your simulation at the bottom.

Dynamic Simulation

👁️ Conclusion

In my example, the VC’s weighted probability cash return from hitting the jackpot with a unicorn exit is €6.4M. This is because its stake is diluted to 12.8% for a value of €128M with a 5% estimated likelihood. The VC estimates a total weighted return of €12.78M, generating a 2.6x multiple of invested capital (MOIC) and an IRR of 32.9%.

Not too bad, you may think. But that’s below the overall target return for a successful early-stage VC fund. Such a fund makes up to, or more than, 5x invested cash to pay back its investors 3x their money, as it charges annual fees and has a carried profit interest. A VC produces a weighted probability of different outcomes analysis for each shortlisted investment opportunity and heavily indexes (i.e., diversifies) its investments to spread the risk between a long tail of failures and few winners. Usually, one or two successful fund exits generate most of a fund’s return(2). In my simulation, this is reflected by the expectation that only 15% of the likely outcomes create a return to the VC fund of 5x or more.

By changing the parameters in the simulation, you can see what happens if the VC lowers its investment amount to €4.0M for a 25% stake. All other assumptions unchanged would imply a post-money ARR valuation of 3.2x. This would increase the VC’s expected MOIC to 3.8x, closer to its desired target return.

In my simulation, the VC expects the best outcome to take six years to come to fruition. This is a good case. Early-stage investors generally do not have the opportunity to exit their best investments for eight to twelve years. Failures will be resolved quicker through write-offs and small M&A exits(3).

To prove my points, consider what the VC industry bible says about valuation, “Early-stage investors can seldom predict whether an opportunity will grow, gain momentum, and generate returns. A classical investment approach is to invest a small amount and gain a seat at the table. It is similar to buying an option to invest in future rounds.(4)”

👁️🗨️ With this knowledge, I hope you can focus on what’s within your control. Put together a winning team building a SaaS product that customers love. Be sure to track and take action on your SaaS KPIs. This is also the core information that helps you to bring on the best VC investors. Finally, understand that when you take VC money, you’re being indexed by the best VC funds and that most other VC funds talk up a level of certainty that does not exist.

Notes

(1) The 10% option pool does not affect headline valuation. It is a shuffle from your equity stake to an equity pool that can be allocated to incentivize your employees going forward. At the exit, your stake will be smaller as a result. This is okay for you and your employees when things go well. However, remember that many other clauses in the non-binding term sheet, like the option pool shuffle, impact whether a headline valuation is acceptable to you.

(2) A VC fund that makes single investments of €5M probably raised €150M, which it invests in twenty SaaS start-ups with a few follow-on investments. To be considered a top-tier VC fund, it needs to generate a total return of 4x, equal to €600M. In this case, the VC fund investors would receive €486M or 3.2x their money back, and the VC partners would earn a total of €114M. The math is that the VC charges 2% annual fees on the fund size or 20% over a 10-year fund lifetime, equal to €30M. This leaves €120M for actual investments. The VC fund investors will receive 1x their money back and 80% of, in this example, net fund profits after that. The VC partners’ share comes from management fees and 20% of the fund profits. To put all this into perspective, if your start-up were to pay back, say, 45% of such a fund’s target return, you’ll have to deliver a €2B exit. Using my simulation, a 12.8% stake worth 45% of €600M, or €270M, equals an exit value of €2,109M.

(3) There are three types of M&A for early-stage VC-backed companies, from low to high value: (1) team, (2) team and technology, or (3) team, technology, and revenue.

(4) “The business of venture capital” by Mahendra Ramsinghani. A VC term sheet typically includes the right to make pro-rata investments in future VC financing rounds.